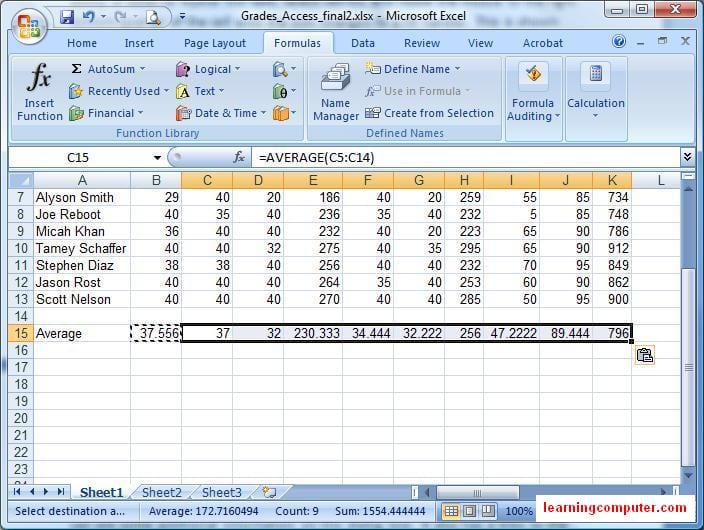

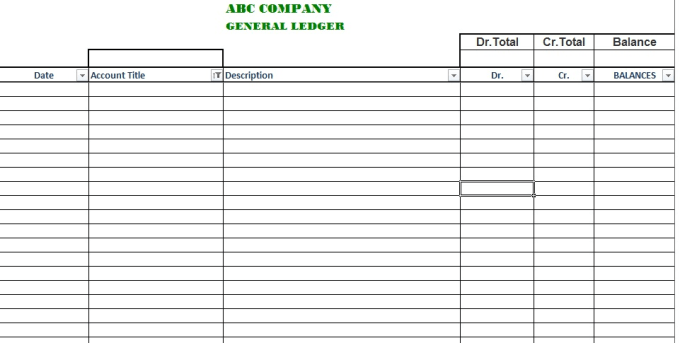

This is straightforward to do with a spreadsheet as it simply requires that you add up all your income, and expenses by category. Are you incorporated?īusinesses that are unincorporated such as sole proprietorships and partnerships generally only require information from a profit and loss statement that then needs to be transcribed onto schedule T2125 of your personal tax return. All of this is much more difficult with a spreadsheet. It can also give you valuable information on re-order points and provide data on what products are selling better than others. Accounting software, when structured correctly, can help you track how much inventory you have, reduce your inventory automatically for every sale and increase it for every purchase. Product based businesses usually need to keep track of the amount of stock they have on hand, which in accounting parlance is referred to as inventory. Analyzing accounting data that in a spreadsheet needs somewhat advanced spreadsheet skills and there is always the possibility of errors. Data that you can query helps you to improve business decisions and ultimately improve your profitability and success. You can see your total sales, sales by customer, sales by product line, profitability, cash flow, sales tax and numerous other reports. One of the great advantages of accounting software, in addition to the time savings and automation, is the ability to analyze your data to keep track of how your business is doing. Do you want to be able to analyze your data ? Conversely, if you only have a couple of customers and your expenses are mostly paid as they are incurred, then a spreadsheet should be adequate. Similarly, if you have suppliers from whom you purchase goods or services such as inventory or subcontractors for which payment can be made in the future, it is important to track these details especially for cash flow purposes. This is most easily accomplished with an accounting software. If you have more than a couple of customers, who pay you after you have sent them an invoice (rather than immediately, upon receipt), you should have a system to track the customers that owe you money, the individual invoices that haven’t been paid and be able to identify late payments. Do you want to keep track of your customer and/or supplier data ?

#Excel based accounting software software

Similarly, if you have a number of expenses or bills, you would have to enter the details manually while with an accounting software there are various levels of automation that can help reduce the time it takes to do these tasks.

With a spreadsheet, you usually have to manually create an invoice and then separately record the invoice and the payment for accounting and tax purposes. The invoice itself can then be duplicated very easily for future transactions. Most accounting software lets you create invoices very easily which then gets recorded automatically as a sale.

However, if you have more than a handful of transactions, then you are likely wasting valuable time by using a spreadsheet. can usually get by with a spreadsheet if they only have a few transactions per month. Very small businesses, freelancers, independent contractors etc. Generally speaking the larger the size of your business the more beneficial it is to use an accounting software. What is the size of your business and how many transactions do you have ? Learn everything that every QBO user needs to know, increase your profitability, and take control of your small business finances with QuickStart Your QuickBooks

#Excel based accounting software how to

Step by step instructions on how to do everyday tasks such as invoicing, expenses, journal entries, banking and sales tax filingĪ review of the essential reports that every business owner should use to analyze their businessĪccounting terminology and best practices every small business owner should know How to migrate your data from QuickBooks desktop or using journal entries (with detailed explanations)Ī review of each of QBO’s numerous features and detailed instructions on how to customize every aspect of your setup (including Canadian sales taxes (GST/HST/QST)) Over 250 pages of tips, tricks, and actionable steps you can implement immediately.Īn examination of which Canadian version of QBO is best for your needs

*Based on the 2021 version of QuickBooks Online* Best of all, no prior accounting knowledge is required - each chapter is explained in an easy to understand way along with screenshots so you never feel lost. The step-by-step guide allows you to learn at your own pace and demystifies common problems that many users of QBO experience.

QuickStart Your Quickbooks, specifically written for Canadian businesses, aims to take you from a complete novice to a confident intermediate user on a timeline that works with your schedule.

0 kommentar(er)

0 kommentar(er)