On the other hand, Amazon has strength in collecting credit sales from the customer, with a 14.96 turnover ratio. Therefore, Amazon is weak in terms of liquidity and might be struggling to pay its short-term debts or might be exhausting its current assets. According to Myšková and Hájek (2017), a working capital ratio of 1.5 and above reflects a company that does not have problems meeting its short-term debt needs. The 1.1 current ratio shows that the company might struggle to meet its short-term obligations. Therefore, Amazon’s D/E ratio equals Amazon’s Strengths and WeaknessesĪmazon presents a weak current ratio, considering that the retail industry’s best ratio should lie between 1.2 and 2.0. The D/E ratio is calculated by dividing total liabilities by total equity (Carlson et al., 2020). The depreciation method used and useful lifespan allocated to equipment and property affect the value of assets reported on the balance sheet and the depreciation expense indicated on the income statement.Ī company’s debt to equity (D/E) ratio indicates whether the business can use its funds to service all its debts in an economic downturn. Amazon uses the straight-line method to calculate amortization and depreciation with a useful lifespan of 40 years for buildings, “three years for servers, and five years for networking equipment, ten years for heavy equipment, and three to seven years for other fulfillment equipment” (Amazon, 2019, p. According to Amzon (2019), equipment includes networking equipment, servers, fulfillment equipment, and heavy equipment, while property comprises land and buildings. Amazon’s allowance for bad debt is calculated as follows:Įquipment and property are considered tangible long-term assets because they have a physical form and offer economic benefits for over a year (Fraser & Ormiston, 2015). The allowance for doubtful accounts is also important as it affects the value of accounts receivables and bad debt expense on the balance sheet and income statement, respectively.

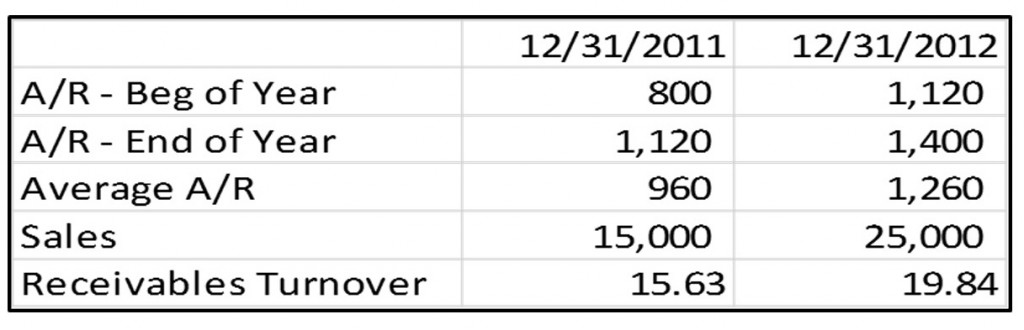

The average accounts receivable for Amazon equals (16677 M + 20816 M) = 18746.5 M (Amazon, 2019).

The ratio is calculated by dividing annual credit sales by average accounts receivable. Therefore,Īccounts receivable turnover is an indicator of a company’s efficiency in using assets, operational and financial performance, and credit policies’ effectiveness.

Amazon’s current assets and liabilities were 96,334 and 87,812 million, respectively. The current ratio is a liquidity test for any business. The working capital or current ratio is calculated by dividing current assets by current liabilities.

0 kommentar(er)

0 kommentar(er)